Price growth in country market turns positive

Knight Frank’s quarterly valuation-based index tracking the price performance and health of the UK prime country house market

3 minutes to read

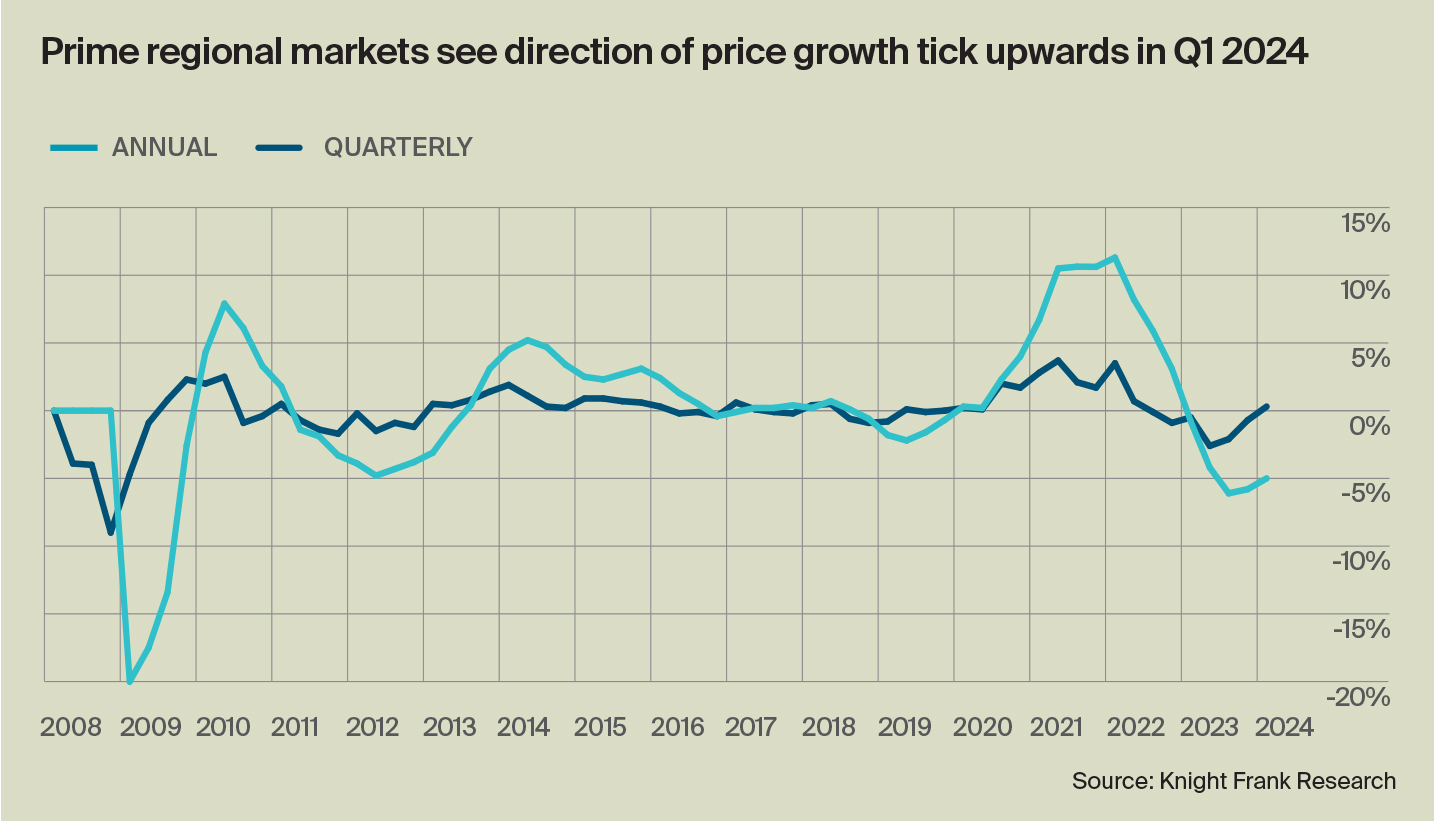

Country home price growth has turned positive on a quarterly basis for the first time in almost two years.

According to the latest results of the Knight Frank Prime Country House Index, which tracks the average value of country homes across the UK, prices increased 0.3% in the first quarter of the year, the last time the index registered positive quarterly growth was in June 2022.

On an annual basis values are down 5%, an improvement on the recent low of -6.1% recorded in September 2023.

Despite the year-on-year decline, values still sit 11.8% higher than they did at the start of the pandemic in March 2020.

The outlook for the rest of the year will be driven by a number of competing factors, not least the timing and pace of interest rate cuts as well as the timetabling of the General Election.

"Needs-based buyers, those moving due to job moves, divorce, schooling etc, have increased their market share as discretionary movers and sellers opted to wait and observe."

Kate Everett-Allen, Head of International and Country Research

STAND-OFF

There is a stand-off between buyers and sellers as higher borrowing costs have tempered budgets resulting in more friction around prices.

Needs-based buyers, those moving due to job moves, divorce, schooling etc, have increased their market share as discretionary movers and sellers have opted to wait and observe.

Analysis shows the lower price brackets continue to register the biggest annual price declines. Homes priced between

£1 million and £2 million registered a decline of 5.7% in the year to March 2024. In contrast homes priced above £5 million dipped 2.4% over the same period.

TIPPING POINT

But the tipping point is coming. Financial markets are still pricing in three rate cuts this year with June considered the most likely month for the Bank of England to make its first move.

March’s inflation reading of 3.2% may be higher than economists anticipated but central bankers will still come under increasing pressure to act as inflation edges closer to the 2% target.

When it becomes clear that a permanent drop in mortgage rates is imminent buyer sentiment

will strengthen.

THE EARLY BIRD…

Spring, the UK’s traditional peak selling season, is slowly seeing stock levels increase. We envisage any potential discounts currently afforded to buyers will start to be eroded once the market gains traction in the coming months.

"Getting ahead of an election removes uncertainty. If you want to move, opting to act prior to a significant political event is a prudent course of action"

James Cleland, Head of Country Business

What impact will the UK General Election have on sales volumes?

A change in government comes with inevitable policy shifts and tax changes but does the lead-up to a general election really silence the housing market in the way commentators would have us believe?

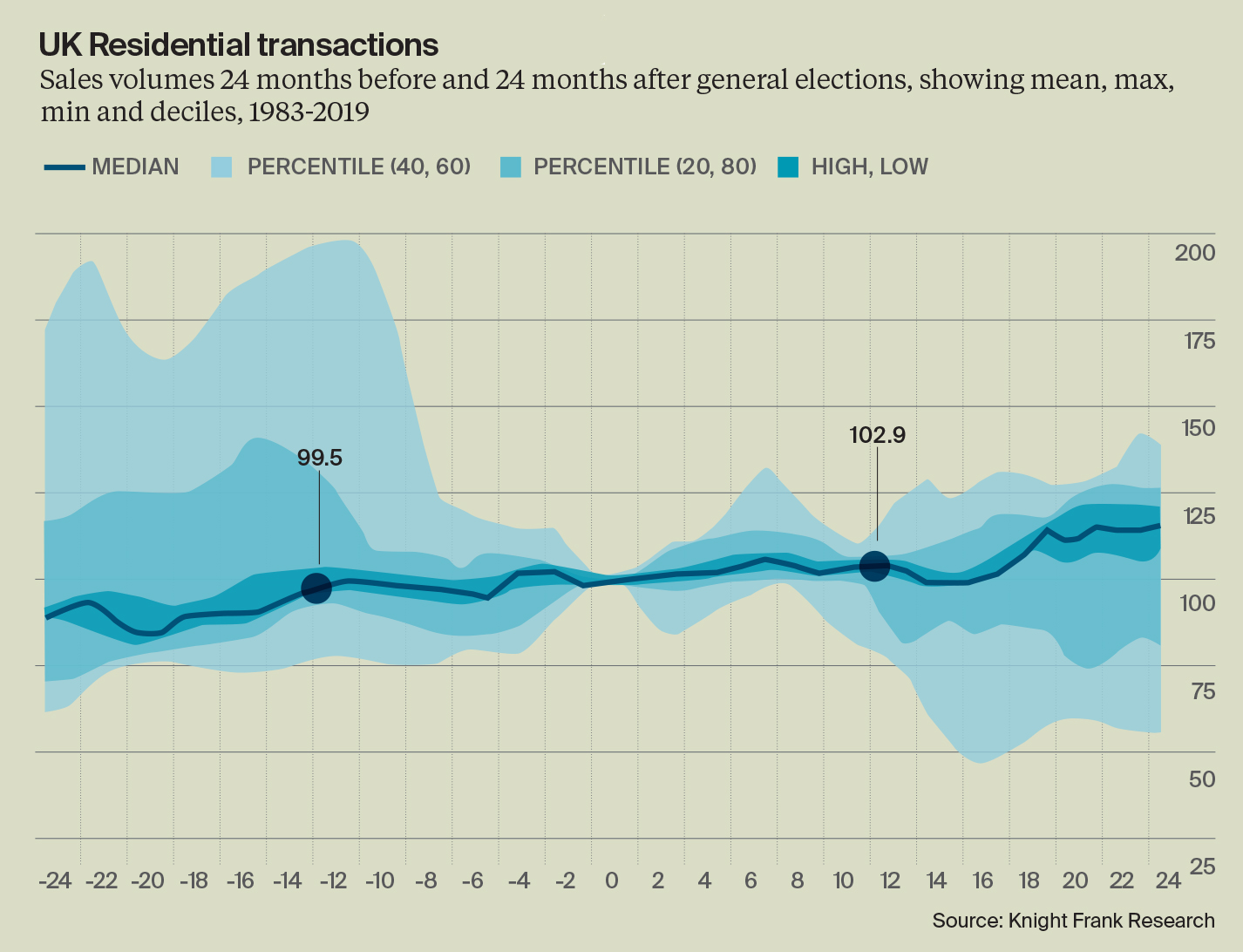

To explore the issue, Liam Bailey, Knight Frank’s Global Head of Research, delved into the data.The chart below measures the 24 months before and after all UK General Elections held between 1983 and 2019.

Zero on the x axis marks the date of the election in each case. The data confirms that there is a marginal dip in sales 12 months prior to the vote but this is more than cancelled out by a stronger post-election bounce in the 12 months following the poll, up 2.9% on average.

In summary, the data confirms that electoral cycles typically do not precipitate significant fluctuations in transaction levels. However, according to James Cleland, Knight Frank's Head of Country Business, "Getting ahead of an election removes uncertainty. If you want to move, opting to act prior to a significant political event is a prudent course of action.”