Addressing embodied carbon in commercial real estate

02 October 2024

Buildings contribute to 39% of the annual global greenhouse gas emissions, with 28% originating from building operations and 11% from building materials and construction processes, known as embodied carbon.

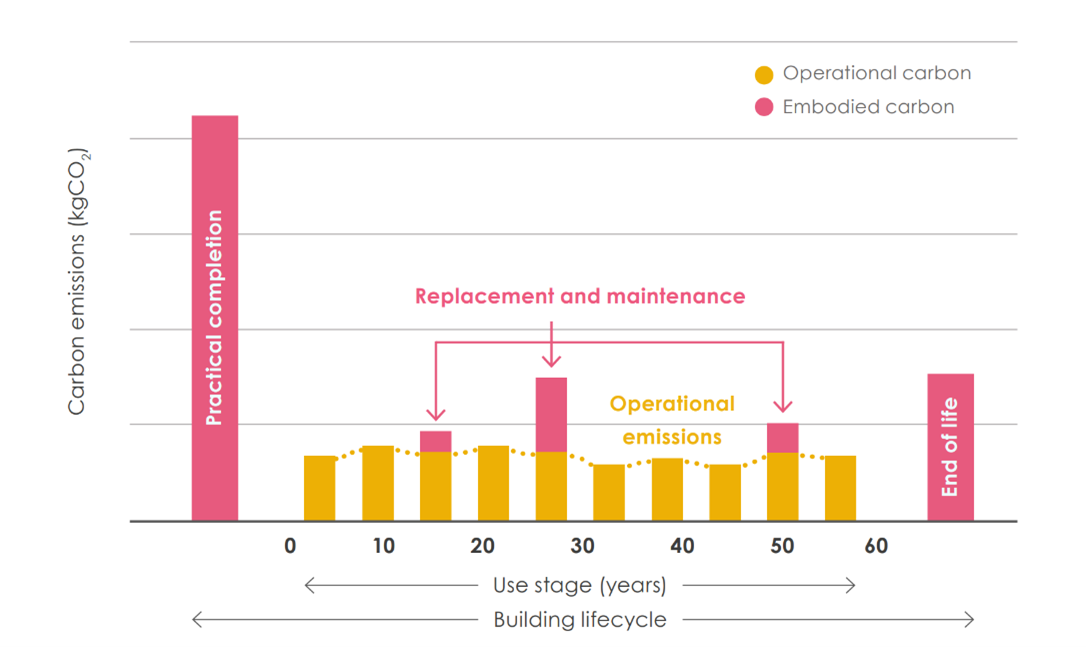

Embodied carbon, found in or produced during the fabrication of building materials, is a significant component of greenhouse gas (GHG) emissions relating to 4 lifecycle stages of a building: product, construction, in-use and end-of-life. Depending on the scope of assessment, it might also account for the maintenance, replacement, deconstruction, disposal, and end-of-life aspects of the materials and systems comprising the asset, known as whole life carbon (WLC).

Factors influencing embodied carbon

3 key factors influence sectoral embodied carbon emissions:

- The design efficiency of projects - the overall quantum and choice of materials used in projects

- The carbon intensity of supply chains - the decarbonisation of industrial processes directly impacts the carbon intensity of construction materials

- Growth rates - The volume of construction activity significantly contributes to embodied carbon emissions.

As operational energy efficiency improves and local grid decarbonisation efforts decrease operational emissions, it is anticipated that embodied carbon emissions will increasingly represent a significant portion of the annual global greenhouse gas emissions from the real estate sector.

The need for change

The consideration of embodied carbon is progressively integrated into the way we plan, construct, maintain, and handle the end-of-life of our constructed assets. Considering the high embodied carbon content of buildings and the built environment, it's imperative to accurately assess a building's carbon footprint over its lifetime.

In terms of the Greenhouse Gas Protocol for emissions accounting, the embodied carbon of built assets is categorised within Scope 3 emissions. To date, most focus has been placed on solutions to minimise operational carbon emissions.

Source: LETI Climate Emergency Design Guide

Strategies for reducing embodied carbon

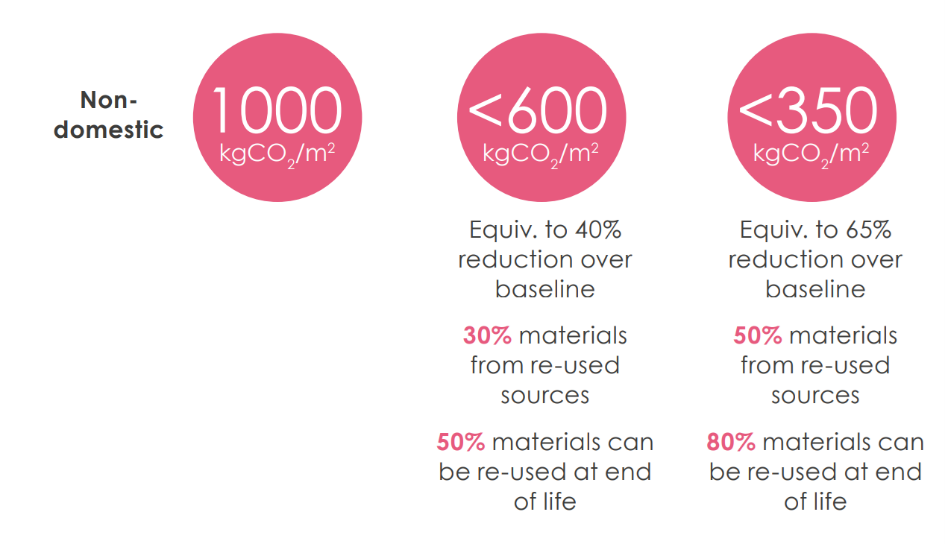

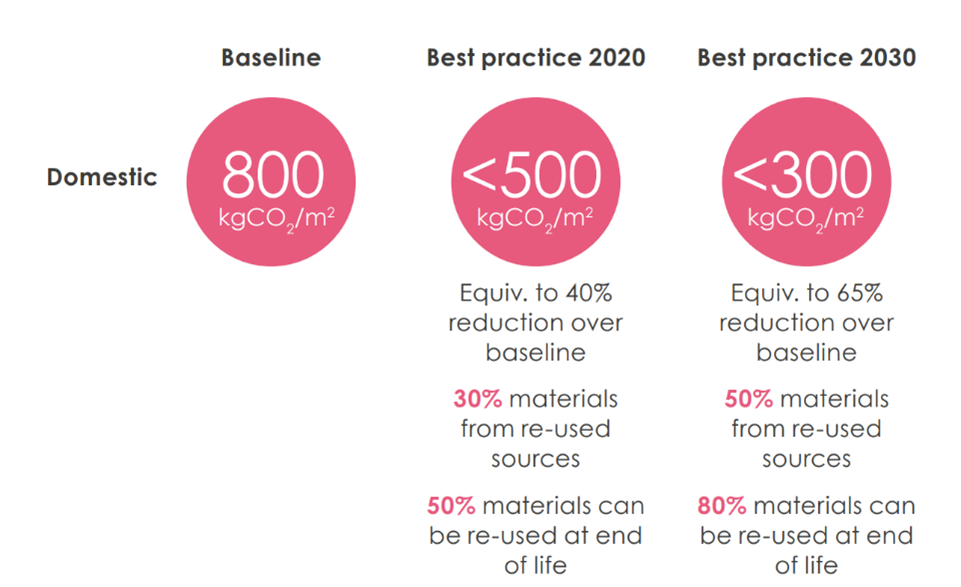

LETI has set key performance indicators for embodied carbon. Strategies to reach these embodied carbon targets include building less where possible, choosing retrofitting over new builds, building lighter and prioritising low embodied carbon materials, consider natural and renewable materials, building for the future with material longevity in mind and collaborating across the industry.

Source: LETI Climate Emergency Design Guide

The role of carbon assessment

The Whole Life Carbon Assessment for the Built Environment, published by the RICS in November 2023, sets the global standard and will be effective from July 2024. It aims to standardise the calculation and reporting of carbon throughout the life cycle of a built asset. This new standard process applies to new construction/new-build units; demolition of existing assets for construction of a new asset; retrofit or refurbishment of existing assets; masterplans of complex sites with multiple buildings, including associated infrastructure assets and civil engineering; and the fit out of built assets. This process breaks down the different parts of the carbon life cycle, including specific modules for embodied carbon. Integrating carbon assessments into projects from the beginning enables considered decision-making in the planning and costing process, which can be developed and updated as the project progresses. Calculations are likely to be based on generic information in the early stages of a project. As designs become more specific, more precise data becomes available. Early calculations are a great aid in assessing project impact and informing decisions.

Looking forward

Optimising a building's overall carbon efficiency involves balancing embodied carbon reduction with minimising operational emissions. Unlike operational emissions, which can fluctuate, embodied carbon is fixed at construction and remains unchanged thereafter.

According to the Net Zero Carbon trajectory to 2050, embodied carbon is forecasted to comprise 50% of built environment emissions by 2035. Failing to address embodied carbon casts uncertainty on the UK's net zero target by 2050.

Over the past 2 decades, embodied carbon emissions have decreased by nearly 20%, driven by reduced construction carbon intensity and increased construction activity. However, measuring and mitigating embodied carbon at the project level is typically voluntary, lacking regulatory mechanisms to incentivise efficiency.

Investment is needed to decarbonise material production, but recent trends show that emissions may remain stagnant or increase without addressing growth in construction and infrastructure despite improvements in carbon intensity.

Efforts to reduce demand for new buildings and materials, improve material efficiency, promote reuse and circularity, and decarbonise construction material supply chains are essential. Additionally, focusing on the circular economy, developing second-hand material markets, and enhancing the utilisation of existing building stock can further reduce embodied emissions and drive sustainable development in the UK.

The role of retrofit in the journey to net zero

Upgrading commercial properties to meet modern energy efficiency standards typically results in lower carbon emissions compared to demolishing and reconstructing them. To align with national emission targets, regulators are increasingly encouraging real estate owners to pursue this approach.

Tenants, occupants, and investors are now more inclined to consider a building's carbon footprint throughout its entire lifecycle—not just its ongoing operations, but also the emissions generated during its construction and demolition. Moreover, there is a growing availability of data to support this assessment.

Retrofitting has proven to enhance returns on investment. Properties with robust sustainability features are commanding higher capital values and rental rates. However, the UK Green Building Council (UKGBC) has identified significant missed opportunities among office investors, owners, and occupants who lack clear retrofit strategies. These missed opportunities include failing to implement simple, cost-effective energy-saving measures and overlooking key moments in lease and maintenance cycles that facilitate efficient retrofitting.

The current pace and scale of commercial building repurposing and retrofits are insufficient to meet the UK's critical net-zero targets. Without decisive action, many property owners risk being left with stranded assets as demand for sustainable spaces rises and minimum energy efficiency standards (MEES) become stricter. Our research shows that of the leases in refurbished office buildings in 2022, just under a half were in offices with an EPC A or B rating. Similarly, for new-build leases, 63% were rated A or B in the same period, making them potentially unrentable by 2030.

How can we support you?

Get in touch with our ESG team to find out how we can support you with embodied carbon.