Why more investors are seeing opportunities in the single family housing for rent market

Investment in the single family housing market jumped significantly last year as investors turned their attention in greater numbers to the suburbs.

7 minutes to read

The single family housing (SFH) sector in the UK is rapidly gaining momentum. Investors spent a record £1.9 billion acquiring or funding more than 6,200 homes last year, up fivefold from £388 million in 2022. In total, SFH investment accounted for just over 40% of all Build to Rent (BTR) investment last year.

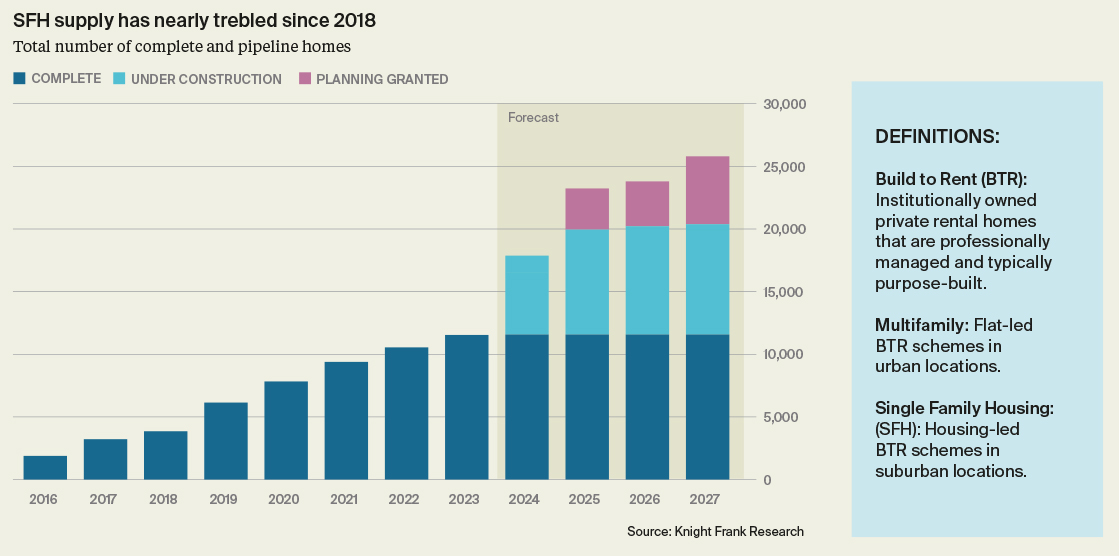

The total number of SFH units in the UK, either existing or proposed, is now just above 26,500, with 11,575 operational and a further 15,000 in the pipeline (under construction or with full planning). The total size of the SFH market, combining both operational homes and pipeline, has nearly trebled since 2018 demonstrating the appetite from developers, investors and lenders for the sector.

A further acceleration in growth is expected, should investors realise their ambitions. Our 2023 survey of more than 50 of the largest investors across the UK Living Sectors (Student, BTR and Seniors Housing) flagged SFH as one of the biggest growth areas, with 71% of respondents saying they plan to target the sector in the coming five years, up from 45% invested today.

New lets in short supply

The need for a step change in both delivery and investment in new high quality rental stock is becoming more urgent. Analysis of listings data shows that the number of houses available to rent across the UK has dropped 41% compared with the 2017-19 average. The fall has been particularly acute for two and three bed houses, a key focus for SFH schemes.

The drop in listings volumes partly reflects the fact that renters are staying in existing properties for longer and moving less often. This means that properties are not cycling back onto the market as quickly or as often as they once did. In 2012, just 19% of all private renters had lived at their current address for more than five years; now that figure is 30%.

Pressures on individual private landlords have also slowed the growth of the buy-to-let sector, with some landlords looking to rationalise portfolios or exit altogether. The net result has been a substantial reduction in the supply of homes to rent.

At the same time, affordability conditions in the sales market have steadily worsened over the last decade, supporting renter demand. Recent rate rises and higher mortgage costs have only added to these pressures. This has resulted in an increase in demand for good quality rental housing from long-term renters, including more families. The growth of the suburban and SFH market is fundamentally aligned with

these changes.

Ultimately, this ongoing imbalance between supply and demand will continue to push up rents.

Housebuilder deals

A willingness on the part of housebuilders to engage with SFH investors has supported an uptick in investment. Some 71% of deals in 2023 were facilitated through transactions with housebuilders, either through bulk deals of stock under construction, or via partnership agreements for yet-to-be-built houses.

The wider economic context makes partnering with an investor to fund projects attractive. Recent trading updates from the listed housebuilders suggest that private sales rates per week are closer to 0.5 than they are to the long-term average of 0.7.

Of course, current market conditions will not last forever. Housebuilder sales rates are incrementally improving as mortgage finance becomes more favourable. However, several housebuilders have started incorporating forward sales models into longer-term business plans over the last 12 months as a way of diversifying income streams. As such, we expect to see more partnership agreements, forward fundings and bulk sales between housebuilders and SFH investors.

More partnerships and JVs with housebuilders have the potential to have a significant impact on SFH supply. The top five housebuilders alone have a combined land bank of more than 350,000 plots. If 30% of these were sold to SFH investors it would add over 100,000 homes to the sector.

Investor priorities

The average size of SFH schemes is getting larger, from an average of 76 homes for current operational schemes to 94 for homes under construction and 176 homes for schemes in the planning pipeline. This is partly a reflection of investors’ desire for scale, but also of a greater understanding of the ideal unit mix, scheme density and economies of scale.

Investors are becoming increasingly discerning with regards to potential sites. As the majority of SFH developments do not have communal amenities, consideration to location is key, particularly when it comes to attracting and retaining tenants. Easy workplace connectivity, proximity to good schools and access to green space are all important for the long-term success of schemes.

Analysis of 153 completed SFH schemes across the country shows that 75% of homes are located within 500m of public transport infrastructure and 80% are within 650m of a public green space. Given the high proportion of families who live in SFH, access to education is key. The analysis shows that 89% have a nursery within 1km, 97% have a primary school and 60% a secondary school.

Who lives in SFH?

The analysis also provides evidence of how existing SFH communities are meeting specific local housing need, with 45% of existing residents having moved three miles or less when they moved into their home.

Some 52% of these tenants are aged over 35. This compares with 34% for multifamily and 72% for the wider PRS market. A slightly younger demographic than the wider PRS market underscores the distinctive demographic that SFH typically draws, often attracting younger families.

Single family housing investor survey

Our Single Family Housing Investor Survey represents the views of 20 leading institutional investors currently active in the market. In total, our survey respondents own and operate a significant proportion of the complete and operational single family rental homes across the UK.

'Significant' increase in investment planned

By 2029, 65% of investors we surveyed said they plan to have significantly increased their exposure to the SFH market in the UK, highlighting the momentum and weight of capital behind the sector. In total, the investors surveyed stated they were looking to commit £17 billion over the next five years. Our calculations suggest that this translates into the potential to fund the development of more than 60,000 new homes at today’s values. Should these ambitions be realised, this will mean the total number of SFH homes, either complete, under construction or in planning, will have nearly trebled from the current level.

SFH supply to become more widespread

The majority of investors (75%) are targeting locations in the South East and the East Midlands, with 70% targeting the South West and 65% targeting the West Midlands. The results chime with our analysis of the development pipeline, with the geographic distribution of schemes shifting as more regional markets are unlocked.

Investor requirements

The current ‘sweet spot’ in terms of scheme size is between 120 and 149 homes, favoured by 65% of survey respondents. Both larger and smaller requirements exist and will be dependent on the supporting nature of the local market demographics and an investor-specific strategies. Indeed, while some investors are happy to deal in smaller lot sizes, most of the current demand is for larger lot sizes as investors look for scale and to drive operational efficiencies. For acquisitions from housebuilders, 63% of investors told us they require a discount to vacant possession of between 10% and 14%.

Operational performance

On average, 55% of the investors we spoke with are targeting gross-to-net income leakage of between 19% and 21%. This reflects the operational efficiencies present at suburban housing schemes (compared to multifamily schemes) with lower levels of communal services and amenity required and longer tenancy terms with fewer voids. The greatest number of investors (32%) are expecting rental growth of between 3% and 4% over the next two years.

Cost of finance is the biggest barrier to deploying more capital

Some 45% of investors highlighted the higher cost of debt as a barrier to deploying more capital into SFH, which reflects the sharp increase in financing costs over the past 18 months. More than half of respondents said access to debt was important or very important to their investment strategy, with 45% expecting their requirement for debt to increase in the coming 12 months. A more positive economic outlook this year has created more clarity over pricing and should give investors the confidence to deploy more capital this year.

Environmental considerations

ESG has become common parlance for property investors, including those active in the SFH sector. Some 90% of those surveyed agreed that ESG is an important consideration for their investments into SFH. Demonstrating this focus, we are seeing more investment in sustainable developments. For investors, this is important for futureproofing assets and lowering any potential regulatory risks. Just over half of survey respondents (55%) are planning on installing air source heat pumps and 50% look towards solar energy solutions. EV charging points are required at SFH schemes by 55% of investors.