European Industrial property market update Q3 2023

With the ECB likely finished with its tightening policy, fixed income yields are not expected to soften further, relieving the upward pressure on industrial property spreads.

5 minutes to read

ECB interest rates may have reached their peak

Inflation in the Eurozone is proving stubborn, with 5.3% reported in August, well above the European Central Bank's (ECB's) 2% target rate. In July, ECB President Lagarde said she did not expect further rate rises. However, the latest inflation figures have prompted the ECB to raise rates a further 25bps in September; this represents the tenth consecutive hike.

Accordingly, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility will increase to 4.50%, 4.75% and 4.00%, respectively. Though the ECB hasn't ruled out a further rate hike, it signalled that hikes were probably at an end, prompting euro zone bond yields and the euro to fall as investors bet on rate cuts next year.

Stable or hardening fixed-income yields will reduce pressure on spreads

With interest rates rising, fixed-income yields have softened over the past two years. Industrial yields have also softened as investors demand a spread over yields available in the bond market. The ECB Euro Area 10-year benchmark bond yield was 3.34% in August 2023, Euro-denominated BBB-rated 10-year corporate bond yields were 4.49%, and AAA-rated corporate bonds were 3.24%.

The robust returns in the bond markets have put upward pressure on property spreads, particularly for industrial property yields that sharpened to record lows in 2022. In Q2 2022, the European NIY was just 3.32% (MSCI). With the ECB likely finished with its tightening policy, we should now see this pressure lifted, though yields in some markets may need to rise further to maintain fair value.

Growth and inflation outlooks remain uncertain

The ECB forecast economic growth of 0.7% this year, followed by 1.0% next year. Meanwhile, Oxford Economics forecasts more moderate growth of 0.5% and 0.9% this year and next and a rapid fall in inflation prompting the ECB to start cutting rates in April next year. Although falling interest rates will mean less upward pressure on yields (due to lower fixed-income yields), the decision to cut rates is likely to be driven by a weakening economy and a need to stimulate growth.

Growing positive momentum for returns

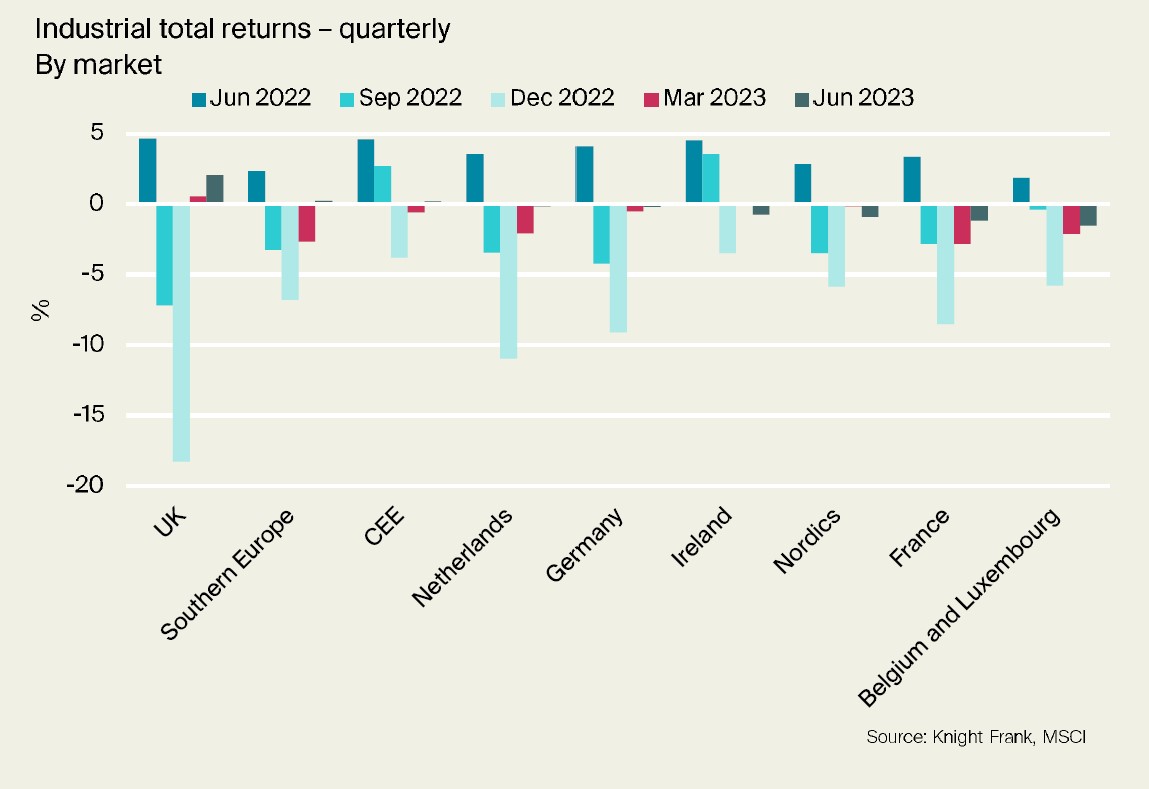

Quarter-on-quarter comparisons show positive returns for some markets, including the UK, CEE and Southern Europe (Q2 2023, MSCI Quarterly European Index). European industrial capital values were down -17.7% y/y in Q2 2023, likely representing a peak-to-trough fall for many markets. However, some markets are further ahead in their repricing journey, and some have repriced more severely than others. Between Q2 2022 and Q1 2023, the UK saw a -25.9 % fall in capital values before positive capital growth returned in Q2 2023.

The scale of repricing in the UK was more severe than in other European markets. This is partly due to the UK being further along in its repricing cycle but also partly due to much more substantial capital growth recorded in the previous two years (Q2 2020 to Q2 2022), with +55.6% growth in average capital values recorded in the UK, compared with 39.7% for Europe as a whole. Since their peak in Q2 2022, capital values are down -19.6% in the Netherlands, they are down -18.1% in France and -17.0% in Germany.

However, more modest repricing has been recorded in CEE, Southern Europe, the Nordics and Ireland. Q3 figures are likely to show a mixed picture for capital value growth; those markets with proportionally smaller falls in pricing could see value eroded further.

Signs of optimism in the investment market

There are already signs of investors taking advantage of better entry pricing. Investment volumes totalled €8.5 billion across Europe in Q2, down -40% compared to the same quarter last year. However, the unfavourable comparison is due to Q2 2022 being a particularly strong quarter with €16.6 billion invested. Compared with Q1 2023, the Q2 total represents a 28% uplift.

The year-on-year comparison also improved relative to Q1 2023 and Q4 2022, which recorded 69% and 60% declines, respectively. The Q2 total is also 28% higher than the pre-pandemic 10-year Q2 average. Markets including the UK, Germany, Spain and the Netherlands saw rises in transaction volumes (Q2 vs. Q1 2023).

With interest rates now at or at least close to their peak, greater certainty around the direction of pricing should bring stability to capital markets, which should help grow transaction volumes.

Despite the recent repricing, refinancing requirements are unlikely to be a concern for the logistics sector due to strong rental and capital growth over the past five years

Rents and capital values have risen sufficiently to cover the lower loan-to-values available and higher income coverage ratio requirements. Average capital values for European industrial real estate have risen 29.4% over the five years to Q2 2023, while market rents have risen 31.8% over the same period (MSCI).

Over the past one and two-year horizons, however, capital value growth has been negative (-17.7% and -0.9% respectively), though forecast capital growth should help protect against a future funding gap.

E-commerce will continue to drive market expansion

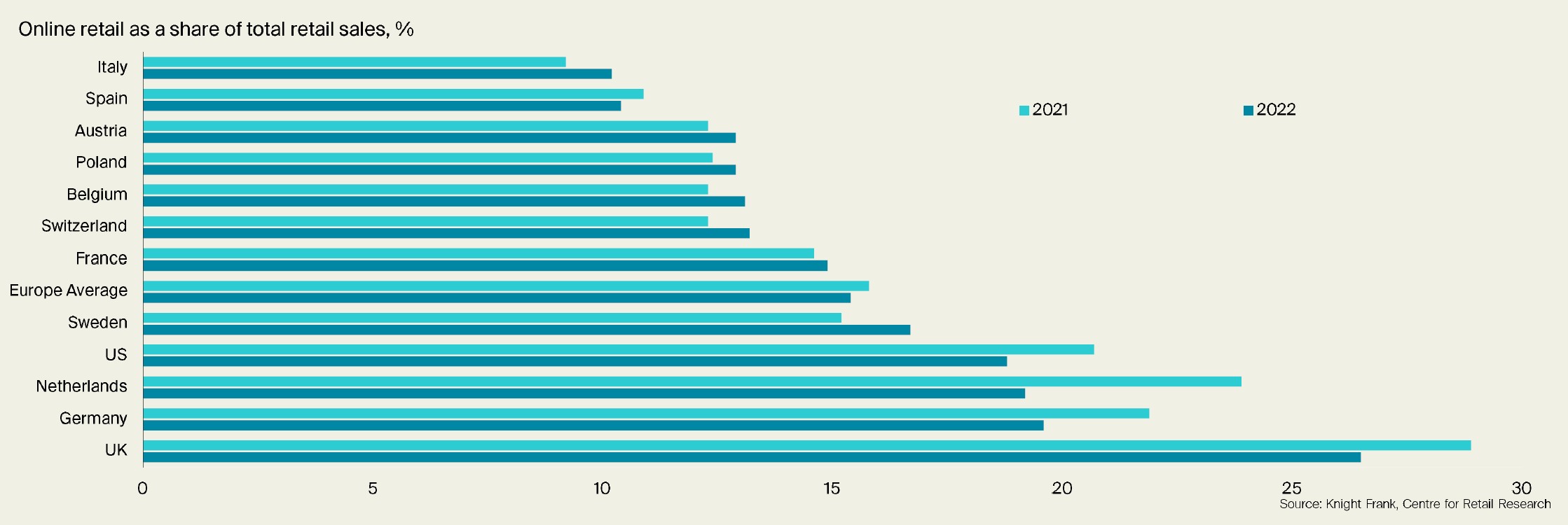

Following the pandemic, 2022 saw a pullback in online retail sales in more mature e-commerce markets. However, countries with lower online penetration rates, including Italy, Poland and France, continued to grow, increasing online penetration rates in 2022.

The UK had an online penetration rate of 26.5% in 2022. UK retailers such as Next and John Lewis & Partners now derive only a minority of their sales from their retail premises. However, in Italy, online sales accounted for just 10.2% of total retail sales last year and 10.4% in Spain.

While further growth of the online retail market in the UK is expected, growth is likely to be faster in markets with lower penetration rates, such as those in Southern Europe and CEE markets. The growth of these markets will require further development of logistics networks and demand specialist fulfilment facilities.

Supply chain pressures have eased, but shifts in the geopolitical landscape and a desire for more sustainable supply chains boost appetite for onshoring

Brexit has also led firms to rethink their supply chains and distribution networks, with additional time and costs driving a need to move parts of the supply chain closer to the consumer.

These factors have helped fuel demand for warehousing space in Europe. Though container traffic remains lower than pre-pandemic levels, cargo volumes are expected to grow, and key European container ports such as Rotterdam or Antwerp remain strategic logistics locations.

Subscribe for more

Get exclusive market analysis, news and data from our research team, straight to your inbox.

Subscribe here