London's chronic undersupply of rental homes is easing, but not by enough

Making sense of the latest trends in property and economics from around the globe.

5 minutes to read

To receive this regular update straight to your inbox every Monday, Wednesday and Friday, subscribe here.

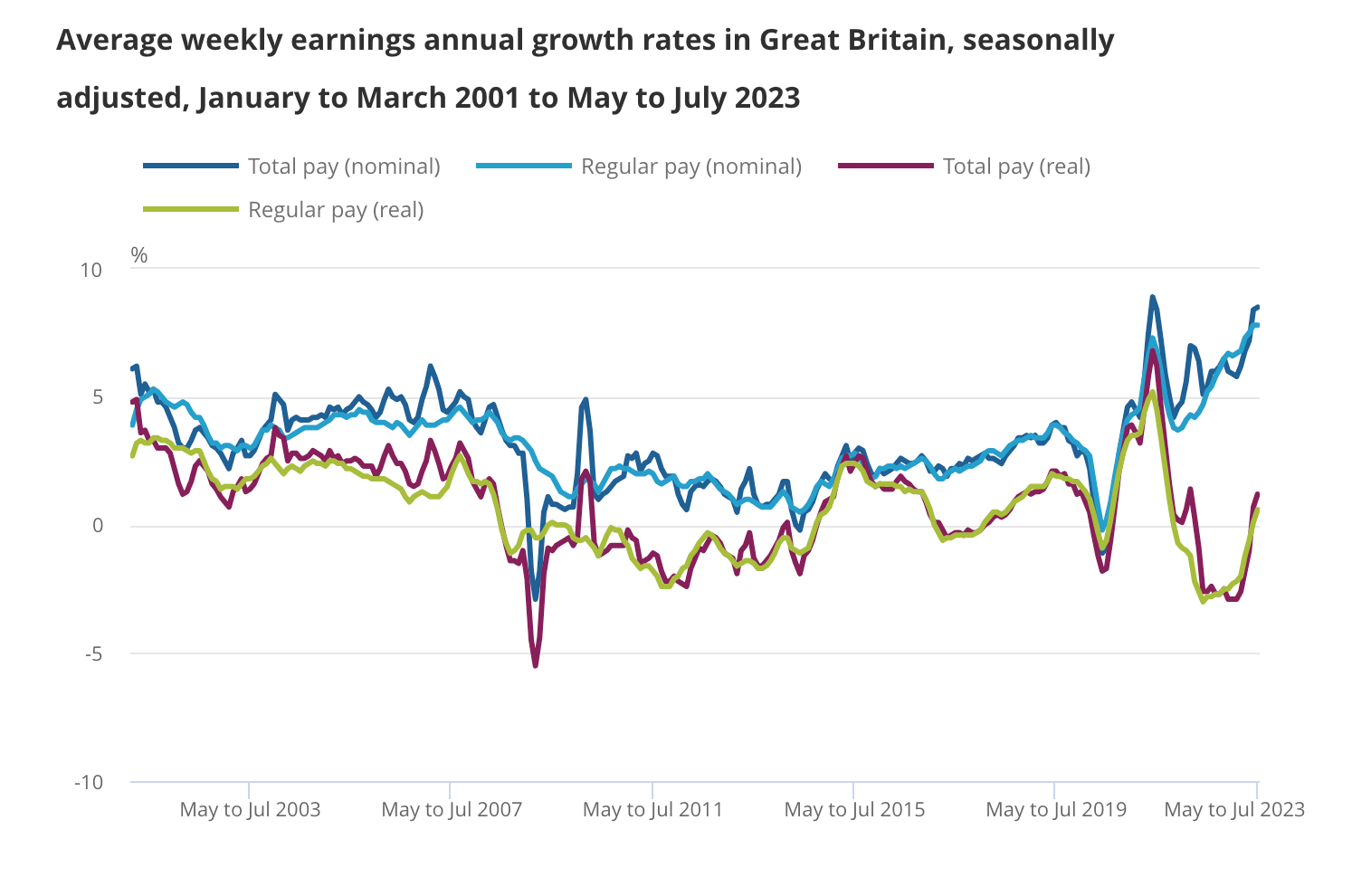

Wages rose at a faster annual rate than inflation during the three months to July, the first time in more than a year that pay packets haven't been eroded by inflation.

While annual pay growth of 7.8% is a small piece of good news for households when inflation is running at 6.8%, it's still the fastest rate of growth since records began in 2001. Whether the base rate is high enough to curtail inflation expectations and by extension wage bargaining within a reasonable timeframe is the key remaining question for Bank of England policymakers ahead of their meeting next week.

The most hawkish Bank of England rate setters want to err on the side of overtightening, while others say interest rates are already sufficiently restrictive. While the pace of wage growth is clearly unsustainable, the broader dataset had something for everyone. The employment rate fell 0.5% to 75.5%, the largest fall on record outside of recessions. The unemployment rate is still low by historic standards but the direction of travel is clear and will empower Monetary Policy Committee members who say interest rates have risen far enough.

Arrears

Mortgage lenders continue to make small rate cuts, though average rates remain above the previous peak set in the aftermath of last year's mini budget.

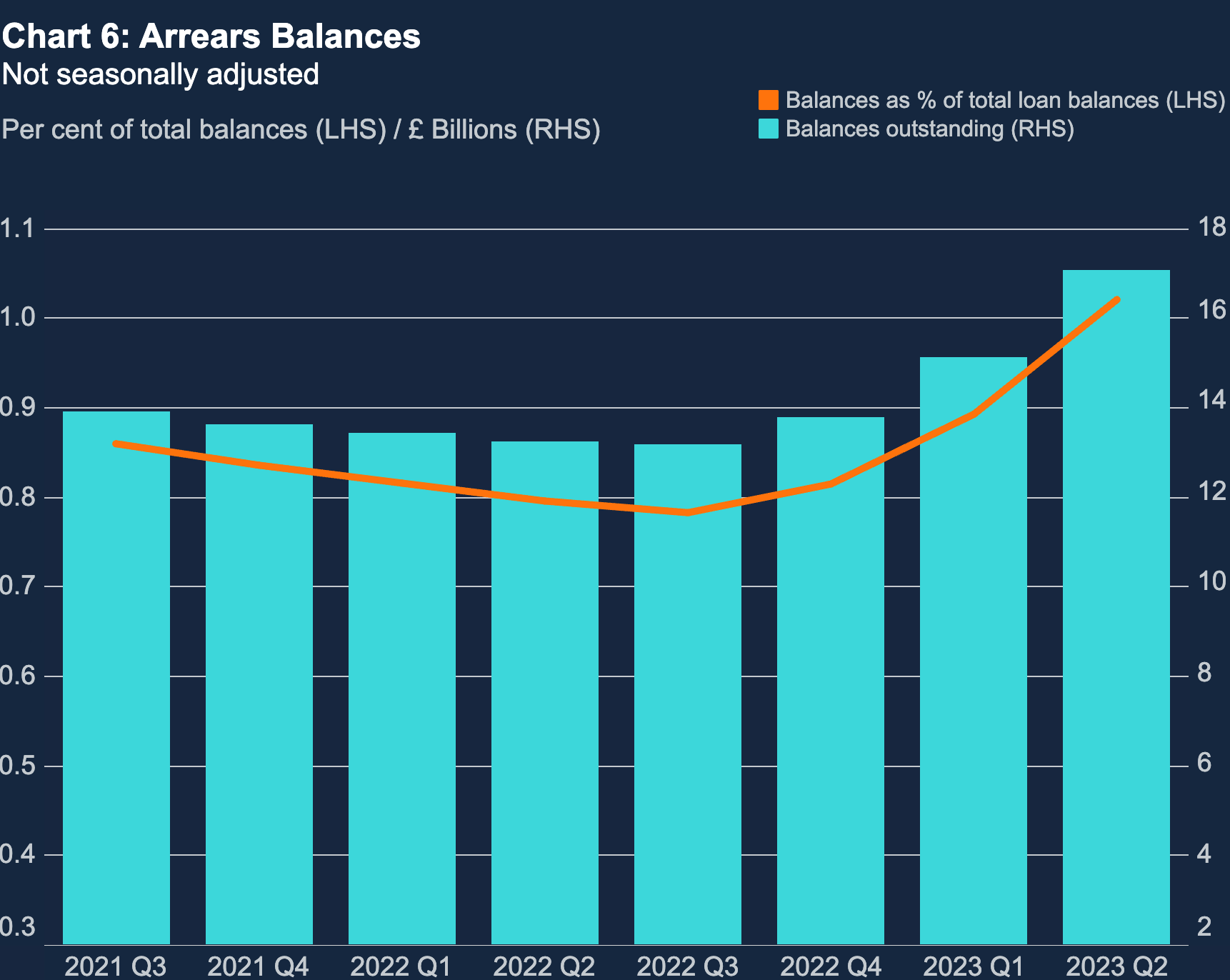

The rapid surge in mortgage rates has fuelled an sizeable uptick in those falling behind on their payments. The value of outstanding mortgage debt with arrears rose to £16.9 billion in Q2, up 29% on the same period a year ago, the Bank of England said yesterday. The situation is clearly painful for those affected, but the situation doesn't yet present a structural threat. The proportion of total loan balances with arrears stands at just 1%, up from 0.89% the previous quarter.

"While mortgage payments at today's rates are painful and require borrowers to cut their discretionary spending, they are still technically affordable," Simon Gammon of Knight Frank Finance tells the BBC. "That's going to keep arrears low despite steep increases in mortgage rates."

Resilience in PCL

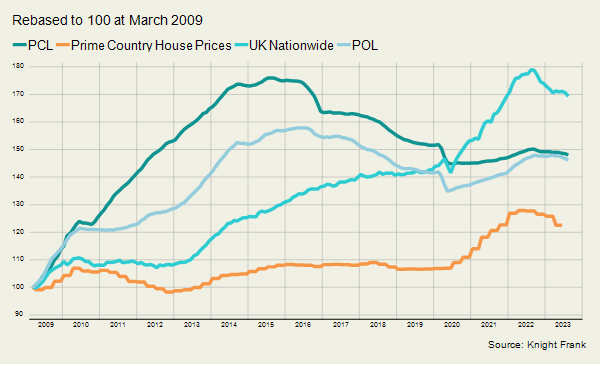

Prime London house prices are proving to be more resilient than those in the broader UK market.

While the Nationwide UK index fell below -5% in the year to August, average prices in prime central London declined by 1.4%, according to the latest Prime Central London (PCL) Sales Index. In prime outer London, the fall was 0.8%. This is partly about relative value - see chart below. Prices are still 16% below their last peak in prime central London, while the figure is 8% in prime outer London. Cash buyers are also more prevalent in PCL.

Activity is also holding up. The number of exchanges in London during July and August was 15% above the five-year average, while the figure was down by 4% across the whole country.

Rental growth eases, a bit

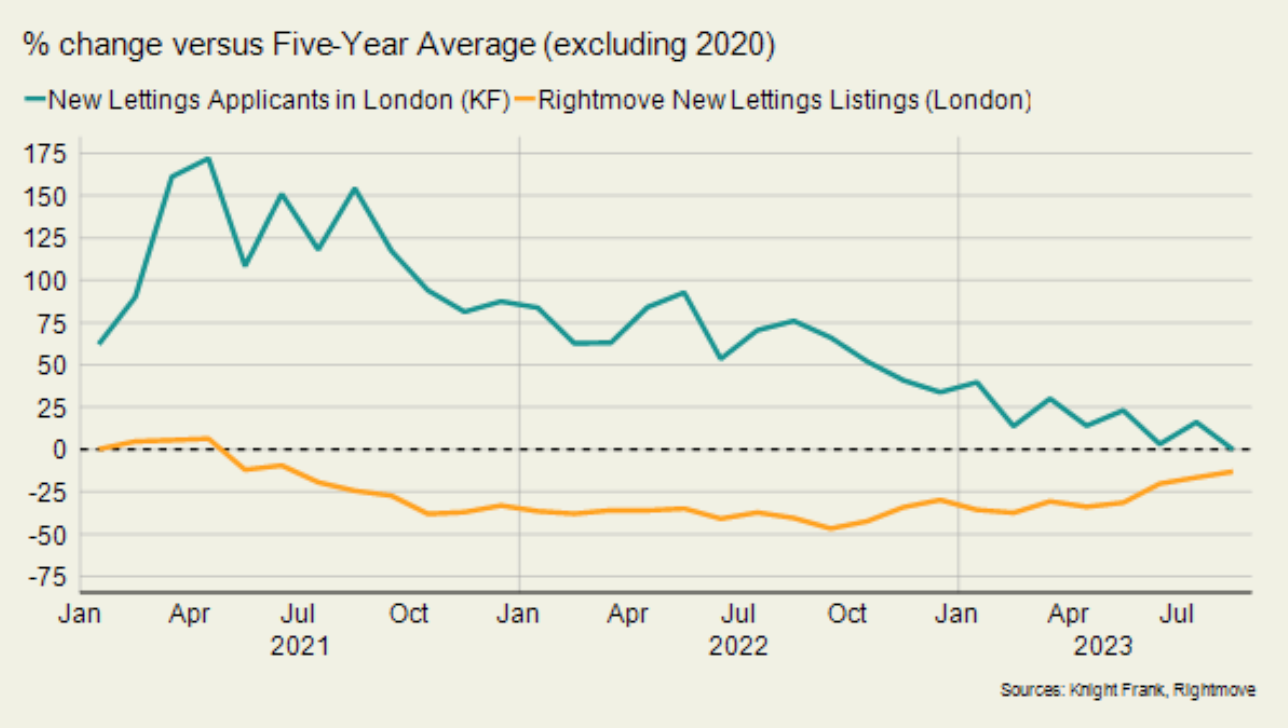

The chronic undersupply of rental homes in the capital is easing, albeit slowly. The number of new lettings listings in the capital was 13% below the five-year average (excluding 2020) in August, Rightmove data shows (see chart). That compares to a decline which was closer to a third during most of last year.

Average rental value growth in prime central London (PCL) eased to 12.4% in the year to August, the lowest level since September 2021. In prime outer London (POL), the figure was 11.5%, the weakest it has been since October 2021.

Supply was boosted to some extent by more owners opting to let out their property due to the weakness in the sales market caused by rising mortgage rates. Meanwhile, demand has dipped over the summer for reasons that include the lower number of Chinese students choosing to attend university in the UK. You can read more from Tom Bill in his latest update here.

Emissions

The Ultra Low Emission Zone (ULEZ) expanded on 29th August 2023 to cover all 32 London boroughs and the City of London. It's a significant decision for some occupiers in the industrial sector - logistics and transportation companies still rely heavily on diesel vehicles due to the limited distance that electric vehicles can travel between charges.

Whether off a low base or not, the impact will still be very real for a large number of businesses, writes Deirdre O'Reilly. Approximately 4,400 additional logistic properties now sit within the expanded footprint, according to Deirdre's analysis of Costar figures (see map). This represents a massive +130% increase from the approximate 3,400 properties that sat within the previous zone, bringing the total number of affected units to 7,800. The additional volume of affected industrial space is in the region of 113 million sq ft, up from approximately 63 million sq ft in the 2021 ULEZ, bringing the total volume now affected to 176 million sq ft.

It’s not just properties located within the boundary that are affected. Within a 25-mile radius of Central London, there are approximately 12,500 units, with many occupiers carrying out day-to-day business within the ULEZ - read the piece here.

In other news...

Investors ploughed £1.6bn into UK AI companies alone during the first six months of 2023, across almost 300 deals. That puts AI above fintech as the leading UK tech vertical for equity investment. Jennifer Townsend considers the implications for real estation.

Elsewhere - ‘Beginning of the end’ of fossil fuel era approaching, says IEA (Guardian), German builders warn of crisis as they scrap record number of projects (FT), Employers and staff seek truce on office working (FT), and finally, UK factory output overtakes France (Times).